Notice of 2021

Annual Meeting of Stockholders

& Proxy Statement

9:30 AM EDT

August 6, 2021

www.virtualshareholdermeeting.com/ATEX2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

pdvWireless,Anterix Inc.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

☒ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: June 21, 2021 |

Notice of 2021

Annual Meeting of Stockholders

& Proxy Statement

9:30 AM EDT

August 6, 2021

www.virtualshareholdermeeting.com/ATEX2021

1

3 Garret Mountain Plaza | Suite 401

Woodland Park, New Jersey 07424

June 21, 2021 To The Stockholders of Anterix Inc. In a year full of challenges worldwide, Anterix turned the corner. We started 2020 in the throes of a regulatory campaign that was critical to realizing our vision for the Company. Today, thanks to the efforts of our incredible team of professionals, the regulations are changed, we have achieved breakthrough successes, and as a result, we are seeing increasing market momentum and tailwinds, a strong boost for our mission to drive what we believe has become a private broadband movement in the utility and critical infrastructure industries. The momentum began building with our team’s success in navigating a highly complex regulatory process at the Federal Communications Commission, resulting in a rule change that transformed our nationwide spectrum into a highly valuable, unique asset. Through deep experience in, and collaboration with, the utility industry, we have fostered and facilitated considerable demand for that asset, thereby developing a high-margin opportunity to monetize the spectrum. With two deals already inked, our team of seasoned wireless, utility, and infrastructure experts is rapidly executing on a plan that has already removed numerous initial business risks and that we believe can result in significant near-term cash flow and clear our path to being fully funded. The utility sector, facilitated by our educational efforts, has unified behind a view of the importance of the modern grid, and its enabling communications component, as driven by private and secure networks that align with Anterix’s vision. Having brought the technology sector along to join this movement, Anterix is now centrally positioned to create incremental value beyond our spectrum offerings. And with beneficial changes in the state and federal policy environment—particularly those emphasizing the importance of grid modernization to achieving decarbonization goals—we believe momentum is truly on our side. In the “Fiscal 2021: The Year in Review” section of this year’s proxy, you will see that, in addition to these major developments, this was also the year Anterix published its first Environmental, Social, and Governance (“ESG”) Report, detailing our efforts around environmental impact, human capital management, social impact, and governance. In the environmental arena, we have honed in on our role in driving positive environmental outcomes. At its core, our vision includes the use of our spectrum to provide the connectivity that will enable our nation to meet its decarbonization and electrification requirements. That is the absolute driving rationale for our product. Simply put, wireless broadband is essential to address the environmental reckoning that all utilities are facing. So, our Anterix vision carries this important sense of purpose with it. As stakeholders, we should all feel great about this, not only because of the enhanced value it provides customers and the opportunity it offers Anterix, but because of the role we will have in addressing this critical national—and global—imperative. On the social front, we have also been very intentional in our focus on Diversity, Equity and Inclusion. We recognize that our business thrives when all perspectives are honored and all voices are heard. Together as Anterix, this is the year we stood up for, and spoke out against, racial injustice and committed, for the long-term, to investing in and dedicating resources to improving and leveraging Diversity, Equity, and Inclusion as key drivers of differentiation and competitive success. We are excited about our growth in this area and are confident that this focus will help us to achieve better business outcomes overall. And with that insight into who we are, we are pleased to invite you to join us at the 2021 Annual Meeting of Stockholders of Anterix Inc. (the “2021 Annual Meeting”). The meeting will be conducted virtually via live audio webcast on Friday, August 6, 2021, at 9:30 am Eastern time. You will be able to attend, vote your shares, and submit your questions during the meeting via live audio webcast at www.virtualshareholdermeeting.com/atex2021. |

2

The enclosed materials include a notice of meeting, proxy statement, proxy card, self-addressed pre-paid envelope, and Annual Report to Stockholders for the fiscal year ended March 31, 2021.

We sincerely hope you will be able to attend and participate in the virtual meeting. Whether or not you plan to attend the 2021 Annual Meeting via live webcast, please authorize a proxy to vote your shares as soon as possible. You may authorize a proxy to vote your shares by mail, telephone, or internet. The proxy card materials provide you with details on how to authorize a proxy to vote by these three methods.

We look forward to receiving your proxy and thank you for your continued support as Anterix takes this momentum into the new fiscal year.

Sincerely,

Morgan E. O’Brien

Executive Chairman

PDVWIRELESS, INC.

Robert H. Schwartz

President & Chief Executive Officer

3

3 Garret Mountain Plaza | Suite 401NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERSWoodland Park, New Jersey 07424

Notice of 2021 Annual MeetingTO BE HELD ON AUGUST 10, 2016of Stockholders

To Our Stockholders:

August 6, 2021

9:30 a.m., Eastern Time

Via Live Audio Webcast:virtualshareholdermeeting.com/atex2021

The 2016virtual 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of pdvWireless,Anterix Inc. (the “Company,” “we,” “our,” and “us”) will be held at the Crowne Plaza Fairfield located at 690 Route 46 East, Fairfield, New Jersey 07004 on Wednesday,Friday, August 10, 20166, 2021, at 9:0030 a.m., Eastern Daylight Time forTime. You will be able to attend the following purposes:Annual Meeting via the internet, vote your shares electronically, and submit your questions during the meeting by visiting: www.virtualshareholdermeeting.com/atex2021.

Items of Business:

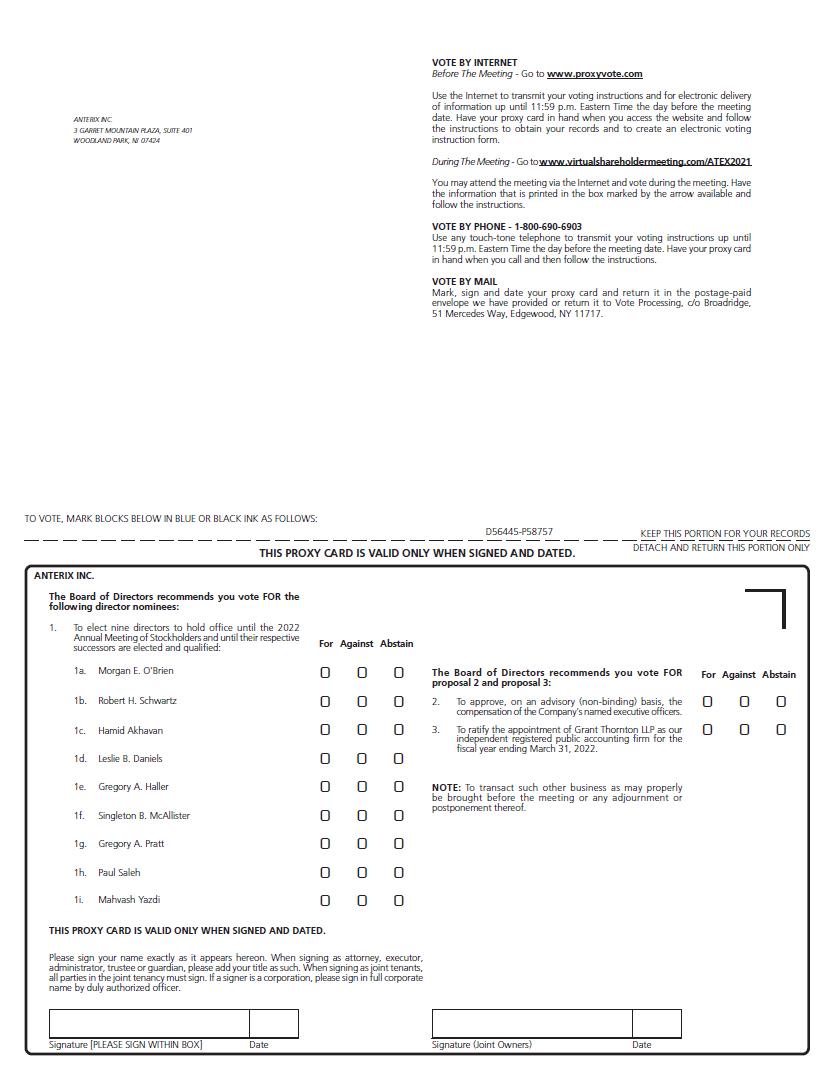

1.To electElection of Directors: Elect nine (9) directors nominated by our seven existing directorsBoard of Directors, each to hold officeserve until the 2017 annual meeting2022 Annual Meeting of stockholdersStockholders and until their respective successors are elected and qualified;

2.To ratifyAdvisory Vote on Executive Compensation: Approve on a non-binding, advisory basis, the compensation of the named executive officers;

3.Ratification of Independent Registered Public Accounting Firm: Ratify the appointment of PKF O’Connor DaviesGrant Thornton LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2017;2022; and

3.4.To transact suchOther Business: Consider any other business as maythat is properly be brought before the Annual Meeting or any adjournment or postponement thereof.meeting

Record Date:

Our Board of Directors recommends a vote FOR each of the director nominees and FOR proposal 2. Stockholders of record at the close of business on June 15, 201611, 2021 (“Record Date”) are entitled to notice of,

and to vote on, all matters at the Annual Meeting and any reconvened meeting following any adjournments or postponements thereof. For ten days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose relating to the Annual Meeting, during ordinary business hours at our corporate offices located at 3 Garret Mountain Plaza, Suite 401, Woodland Park, New Jersey 07424.

Proxy Voting:

All stockholders are invited to attend the virtual Annual Meeting in person.Meeting. Whether or not you expect to attend the Annual Meeting, you are urged to read this Proxy Statement and vote or submit your proxy as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions.instructions. Telephone, mail, and internet voting are available. For specific instructions on voting, pleasePlease refer to the instructions in this Proxy Statement and on your proxy card.card for specific voting instructions. If you hold your shares through an account with a broker, bank, trustee, or other nominee, please follow the instructions you receive from them to vote your shares. Please refer to the section “Additional Information” for detailed information on accessing the meeting, voting, and asking questions at the meeting.

Important Notice Regarding Availability of Proxy Materials for the Annual Meeting: Our Annual Report and Proxy Statement are available at http://www.viewproxy.com/pdvWireless/2016.

By Order of the Board of Directors,

John C. Pescatore

Chief ExecutiveLegal Officer and PresidentCorporate Secretary

Woodland Park NJ |June 29, 201621, 2021

Important notice regarding the availability of proxy materials for the 2021 Annual Meeting of Stockholder: This Proxy Statement for the 2021 Annual Meeting of Stockholder, our Annual Report to Stockholders on Form 10-K for the fiscal year ended March 31, 2021 (filed June 15, 2021) and the proxy card or voting instruction form are available on our website at www.investors.anterix.com/financials/annual-reports-and-proxies.

4

Table of Contents

9 | |

| 6 | |

| 8 | |

| 9 | |

| 11 | |

| 12 | |

| 13 | |

| 13 | |

| 13 | |

| 15 | |

| 15 | |

| 15 | |

| 15 | |

| 15 | |

Board of Directors, Board Committees, and Corporate Governance Matters | 21 |

| 21 | |

| 21 | |

| 21 | |

| 22 | |

| 23 | |

| 23 | |

| 24 | |

| 24 | |

| 25 | |

| 28 | |

| 30 | |

| 31 | |

Advisory Vote to Approve Compensation of Our Named Executive Officers | 31 |

| 32 | |

| 36 | |

| 41 | |

| 41 | |

| 42 | |

| 44 | |

Ratification of Appointment of Independent Registered Public Accounting Firm | 44 |

| 44 | |

| 46 | |

| 47 | |

| 49 | |

| 51 |

5

Fiscal 2021: The Year In Review

A Transformative Year for Anterix

During Fiscal 2021, we uniquely positioned ourselves to leverage our 900 MHz spectrum to enable secure, resilient, customer-controlled private LTE solutions that add value and drive power grid modernization for utilities. And in so doing, we began fostering momentum across a growing and maturing pipeline and are experiencing positive tailwinds due to the enhanced focus from the utility industry and the federal government on grid modernization, decarbonization, and cybersecurity. Further, this increased attention has allowed us to play a pivotal role in convening the entire utility sector ecosystem, including the technology developers, to continually enhance the value of a private LTE solution in solving critical use cases, with the ultimate benefit of driving continued adoption.

FCC Approves Report and Order

Early in Fiscal 2021, after a nearly six-year pursuit of our petition at the Federal Communications Commission (“FCC”), the FCC approved a Report and Order to modernize and realign the 900 MHZ band to increase its usability and capacity by allowing it to be utilized for the deployment of broadband networks, technologies, and solutions; thereby, allowing us to repurpose otherwise under-utilized spectrum, unleashing the power of broadband for utilities and other enterprises to build private LTE communications networks.

First Two 900 MHz Spectrum Agreements

We signed our first 900 MHz spectrum lease, a 30-year deal with Ameren—a power utility serving most of Missouri and western Illinois—worth approximately $48 million. We also signed a second deal with San Diego Gas & Electric (“SDG&E”), worth roughly $50 million, under which we sold spectrum to SDG&E in their service territory that will result in the utility becoming the license holder for 900 MHz broadband spectrum that will be used to build a private LTE network that will support smart-grid and wildfire-mitigation initiatives.

Active Ecosystem Launch

We launched the Anterix Active Ecosystem with 37 (now over 40) high profile technology industry leaders brought together to provide technical and marketing support to a broad ecosystem of technology innovators to bring extensive value to utilities and critical infrastructure deploying and operating 900 MHz private LTE networks.

Strategic Deals

We reached an agreement with Nokia to offer private LTE over low-band dedicated spectrum and a private LTE technology Agreement with Motorola.

Strengthened Leadership Team and Board of Directors

We assembled an extraordinary executive leadership team with deep experience to drive strategic and transformational outcomes and nominated seven distinguished independent board members with significant experience in technology, the utility sector, emerging growth companies, finance, and regulatory matters to drive continued momentum.

Our Environmental, Social, and Governance Efforts

We are proud to have published our first Environmental, Social, and Governance (“ESG”) report this year. The report contains information about our approach to ESG and details our efforts around environmental impact, human capital, social impact, and governance and is posted on our website. It also provides further insight into our overarching ESG strategy, which includes a focus on leveraging 900 MHz spectrum solutions to help drive carbon reduction and other sustainability goals associated with assisting our customers in modernizing and protecting the electric grid; stakeholder engagement on ESG issues as we share our ESG initiatives with our investors; designation of the Nominating and Corporate Governance Committee with oversight responsibility for developing our ESG Strategy, integrating ESG into our purpose and vision, and reporting to the Board on our ESG Strategy progress. We have provided selected highlights of our ESG efforts in the section below entitled “Environmental, Social, and Governance Oversight.”

UBBA Alliance

Utility Broadband Alliance (“UBBA”) officially incorporated as a 501(c)(6) not-for-profit association dedicated to advancing and developing private LTE broadband as a key communications infrastructure for a secure, resilient, digital grid. As a founding

6

member and diamond-level sponsor, we collaborate with utilities and ecosystem partners dedicated to championing the advancement and development of private broadband networks for America’s critical infrastructure. For more information, go to www.ubba.com.

7

2016 Proxy Statement Summary

To assist you in reviewing the Proxy Statement, for the 2016 Annual Meeting of Stockholders (the “Annual Meeting”) of pdvWireless, Inc. (the “Company,” “we,” “our,” and “us”), we call your attention to the following summary information about the 2021 Annual Meeting of Stockholders and our corporate governance framework. For more complete information, please carefully review thisthe entire Proxy Statement and our Annual Report on Form 10-K (“Annual Report”) for the fiscal year ended March 31, 20162021 (“Fiscal 2016”2021”). We encourage you to vote your shares at the Annual Meeting. If you are unable to attend the Annual Meeting in person, we encourage you to submit a proxy so that your shares will be represented and voted. before voting.

Annual Meeting of Stockholders

Date and | August |

|

|

Record | June |

| If you were a “stockholder of record” or beneficial owner of shares held in “street name” as of the close of business on the Record Date, you may vote your shares. |

|

|

If you need technical support to access the meeting, there will be a toll-free number and an international number available on the website to assist you. Technical support will be available 15 minutes before the start time of the meeting and through the conclusion of the meeting.

Proposals and Voting Recommendations

|

| |||

| ||||

|

|

| ||

|

|

| ||

i

Director Nominees

The following table provides summary information about each of the individuals nominated for election at the Annual Meeting:

|

|

|

|

|

|

| |

Item | Board Recommendation | Page Reference (for more detail) |

(1) Election of Directors | FOR each of the nominees listed on the enclosed proxy card | 15 |

(2) Approval, on an advisory (non-binding) basis, of the compensation of our named executive officers | FOR | 31 |

(3) Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2022 | FOR | 44 |

How to Cast Your Vote

You have three different methods to vote your proxy. Please see the enclosed proxy card or voting instruction form for additional details regarding each voting method.

|

|

|

| |||||||

| By Internet or Computer | By Telephone | By Mail | |||||||

|

|

|

|

| ||||||

|

|

|

|

|

| |||||

|

|

|

|

|

| |||||

| Vote 24/7 | Dial toll-free 24/7 | Cast your ballot, sign your proxy card |

| ||||||

| ||||||||||

| ||||||||||

|

|

|

|

|

| |||||

|

| |||||||||

| ||||||||||

| ||||||||||

|

|

|

|

|

| |||||

|

| |||||||||

| ||||||||||

| ||||||||||

|

|

|

|

|

| |||||

|

|

| ||||||||

|

| |||||||||

|

| |||||||||

|

|

|

|

|

| |||||

|

|

| ||||||||

|

| |||||||||

|

| |||||||||

|

|

|

|

|

| |||||

|

|

| ||||||||

|

|

| ||||||||

|

| |||||||||

| ||||||||||

|

|

|

|

|

| |||||

|

| |||||||||

| ||||||||||

| ||||||||||

send by pre-paid mail |

ii

8

Corporate Governance Summary FactsBoard Nominees and Demographics

The Director nominees are proven leaders with a broad range of competencies, professional experience, and backgrounds. Each of our nominees brings a unique set of skills and diverse viewpoints to the Board. Importantly, the Board also recognizes the value of new perspectives and ideas and, in conjunction with executing its succession plan in 2020, the directors took the opportunity to strengthen our Board by adding new directors Gregory A. Pratt, Hamid Akhavan, Leslie B. Daniels, and Robert H. Schwartz, all of whom are nominees this year as well. The Board subsequently appointed Mahvash Yazdi as a director in February 2021, bringing the number of directors added within the last year to five. The Board then named Singleton McAllister as its Lead Independent Director. Of our nine directors, two are female, and two are ethnically/racially diverse.

The following table summarizes our current Board structure and key elements of our corporate governance framework:

Vo |

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

| |||

Nominee | Age | Director Since | AC | CC | NCGC | SC | Independent | Other Current Public Company Boards | |||

Morgan E. O’Brien** | 76 | 2012 |

|

|

| M | -- |

| |||

Robert H. Schwartz | 55 | 2020 |

|

|

| M | -- |

| |||

Hamid Akhavan | 59 | 2020 |

| M | M |

| X | Vonage Holdings Corp. | |||

Leslie B. Daniels | 74 | 2020 |

| M | M | C | X | GAMCO Investors, Inc. | |||

Gregory A. Haller | 54 | 2018 | M | M |

|

| X |

| |||

Singleton B. McAllister* | 69 | 2018 |

|

| C | M | X | Alliant Energy Corp.; Securitas Infrastructure Services (Proxy Board) | |||

Gregory A. Pratt | 72 | 2020 | M | C |

|

| X | Carpenter Technology Corp. | |||

Paul Saleh | 64 | 2016 | C |

|

| M | X |

| |||

Mahvash Yazdi | 69 | 2021 | M |

| M |

| X | NorthWestern Energy | |||

|

|

|

AC = Audit Committee | C = Chair | |

CC = Compensation Committee | M= Member | |

NCGC = Nominating and Corporate Governance Committee | **Board Chair | |

SC = Strategy Committee | *Lead Independent Director |

9

Board At A Glance

Nominee Skills and Experience | Nominee Diversity | |

|

|

|

| |

Size of Board (set by the Board) |

| |

Number of Independent Directors Nominees |

| |

Chairman and CEO | Separate | |

Board Self-Evaluation | Annual | |

Review Board and Board Committee Qualifications | Annual | |

|

| |

| Hold Executive Sessions | Yes |

Annual Director Elections | (No Classified Board) | Yes |

Majority Voting |

| |

Diverse Board (as to background, experience, and skills) | Yes | |

Board has Adopted Corporate Governance Guidelines | Yes | |

No Related Party Transactions with Officers or Directors | TRUE | |

Board has Not Amended Charters or Taken Actions to Reduce Stockholder Rights | TRUE | |

All Directors with More than One Year of Service Own Stock | Yes | |

No Family Relationships Among Officers and Directors | TRUE | |

All Standing Committee Chairs and Members Qualify as Independent Directors | Yes | |

CEO Serves on Less Than Three Outside Boards | TRUE | |

Independent Director Nominees Serve on Less Than Four Outside Boards | TRUE | |

Stock Ownership Guidelines | Yes | |

Lead Independent Director | Yes |

10

Our Executive Compensation for Fiscal 2015Program

Our Executive Compensation Program, supported by our official Compensation Philosophy, is designed to attract, motivate and Fiscal 2016retain talent to grow our business. To support this desired outcome, we focus on aligning executive pay with individual performance, company performance, and stakeholder interests. The Compensation Committee regularly reviews best practices in governance and executive compensation. The following is a summary of the current executive compensation practices utilized by the Compensation Committee to drive Company performance and serve our stockholders’ long-term interests:

Key Elements of Executive Compensation

Our Board of Directors (the “Board” or “Board of Directors”) established a Compensation Committee reviewscomprised of four independent directors in accordance with the rules and approves all compensation decisions relatingregulations established by the Securities and Exchange Commission (the “SEC”) and the Nasdaq Stock Market. Our Board delegated to our executive officers, including our named executive officers, and oversees and administersthe Compensation Committee the authority to establish our executive compensation program. Our independent directors acting as a Special Committee establishedprogram and approve all compensation received by the Board of Directors effectively served as the compensation committee and approved a number of compensation decisions during Fiscal 2015 in connection with the recapitalization of the Company and our June 2014 private placement financing.

Ourexecutive officers. The Compensation Committee is focused on designing aretained Korn Ferry Hay Group (“Korn Ferry”) as its independent compensation program that attracts, retains, and incentivizes talented executives, motivates themconsultant in October 2020. Prior to achieve our key financial, operational, and strategic goals, and rewards them for superior performance. It is also focused on ensuring that our compensation program aligns our executive officers’ interests with thosethe appointment of our stockholders by rewarding their achievement of specific corporate and individual performance goals.

In June 2014, our independent directors established our initial executive compensation program, consisting of a base salary, an annual performance-based cash bonus program and a long-term equity award plan consisting of the grant of time-based stock options. At that time, we were a private company, and had just completed a recapitalization and the private placement in which we raised funds to purchase our 900 MHz spectrum. The time-based stock option awards issued to our executive officers in Fiscal 2015 (the period from April 1, 2014 to March 31, 2015) reflected the recapitalization of the Company and the fact that many of our executive officers and key employees were new hires and received their initial equity awards upon joining our Company during Fiscal 2015.

Because our executive officers received stock option awards in June 2014 or thereafter upon joining the Company, our Compensation Committee elected not to grant equity awards to our executive officers at the beginning of Fiscal 2016 (the period from April 1, 2015 to March 31, 2016). In August 2015, the Compensation Committee retainedKorn Ferry, Pearl Meyer & Partners, LLC served as itsthe Compensation Committee’s independent compensation consultant,consultant. Our Fiscal 2021 runs from April 1, 2020 through March 31, 2021.

Executive Leadership Succession Plan: In June 2020, we announced an executive leadership succession plan (the “Succession Plan”), which followed the FCC’s issuance of the Report and Order. As part of this Succession Plan, Morgan E. O’Brien transitioned from Chief Executive Officer to assist it in selectingExecutive Chairman and Robert H. Schwartz was promoted to President & Chief Executive Officer. In October 2020, Chris Guttman-McCabe was appointed as the Chief Regulatory and Communications Officer. Mr. Guttman-McCabe previously led our regulatory efforts with the FCC as an appropriate peer group of public companies for purposes of executive compensation and to evaluate our compensation program and the compensation levels we currently offer to our executive officers. Based on this evaluation, theexternal consultant.

Executive Compensation Philosophy: The Compensation Committee issued time-based and performance-based equity awards in January 2016 to our executive officers. Although these equity awards were granted during Fiscal 2016 and are included in thehas adopted a compensation tables included in this proxy statement, the Compensation Committee granted these equity awards as the long-term equity award component of the compensationphilosophy for our executive officers and other senior management. Specifically, the objectives of the executive compensation program are to:

Attract, motivate, and retain the critical talent that will receive for Fiscal 2017 (the period from April 1, 2016continue to March 31, 2017).

iii

TABLE OF CONTENTS

grow our business:

· |

|

| |

| |

iv

v

PDVWIRELESS, INC.3 Garret Mountain Plaza, Suite 401Woodland Park, New Jersey 07424

PROXY STATEMENT FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERSTO BE HELD AUGUST 10, 2016

This Proxy Statement, along with a proxy card,is being mailed to our stockholders on or before July 1, 2016business objectives:

· |

|

· | Continue to foster an entrepreneurial, high-performance, and results-driven culture. |

We have mailed these proxy materials

11

Align Executive Compensation with Stockholder Interests- Achieve long-term business success and deliver strong and sustainable returns to you in connection with the solicitation by the Board of Directors (our “Board” or the “Board of Directors”) of pdvWireless, Inc. of proxies to be voted at the 2016 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Wednesday, August 10, 2016 at the Crowne Plaza Fairfield located at 690 Route 46 East, Fairfield, New Jersey 07004 at 9:00 a.m. Eastern Daylight Time and any adjournments or postponements thereof. References in this proxy statement to the “Company,” “we,” “our,” and “us” are to pdvWireless, Inc. and its subsidiaries.our stockholders:

· | Align our employees’ interests with those of our stockholders without encouraging excessive or imprudent risk-taking or decision making. |

· | Calibrating realizable pay opportunities to mirror the stockholder experience in the proper sharing ratios, recognizing the long sales cycle and collaborative selling requirement’s impact on short-term performance and related stockholder experience. |

Holders

Executive Compensation Program:To effect the Compensation Philosophy, our Compensation Committee established an executive compensation program consisting of: (i) an annual base salary, (ii) an annual performance-based bonus program, payable in cash and/or shares of common stock, and (iii) a long-term equity award consisting of time-based and/or performance-based equity awards.

Elimination of Evergreen Provision: The Compensation Committee amended our 2014 Stock Plan to eliminate the evergreen provision that previously provided for an automatic annual increase in the number of shares of our common stock (the “common stock”),reserved for future issuance under our only class2014 Stock Plan. Going forward, any increases in the number of issuedshares reserved under our 2014 Stock Plan will need to be approved by our Board of Directors and outstanding voting securities,our stockholders at an annual or special meeting of stockholders.

Executive Compensation Recoupment Policy: Our Executive Compensation Recoupment (“Claw-back”) Policy gives us the closeright to cancel or “claw back” incentive compensation from any senior executive who has engaged in misconduct that results in (i) significant reputational or financial harm to Anterix or (ii) a material financial restatement.

Advisory Vote on Executive Compensation – “Say on Pay” Vote:

We conducted an advisory vote on executive compensation at our annual meeting of business on June 15, 2016 (the “Record Date”) are entitledstockholders in 2020. Approximately 81% of the votes cast supported the proposal. Our Board and our Compensation Committee value the opinions of our stockholders, and we believe it is important for our stockholders to have an opportunity to vote on this proposal annually, which is consistent with the proposals presented atfrequency preferred by our stockholders who voted in 2020 as well. In addition to our annual advisory vote on executive compensation, we are committed to ongoing engagement with our stockholders on executive compensation and corporate governance issues.

Note:On or about June 21, 2021, we began sending this Proxy Statement, the attached Notice of Annual Meeting. AsMeeting of June 15, 2016, 14,300,790 shares of our common stock were issuedStockholders, and outstanding.

The presence, in person or bythe enclosed proxy of the holders of a majority of the issued and outstanding shares of common stockcard to all stockholders entitled to vote at the 2021 Annual Meeting. Although not part of this Proxy Statement, we are also sending, along with this Proxy Statement, our 2021 annual report on Form 10-K, which includes our financial statements for Fiscal 2021.

12

If you are a stockholder of record, you can vote in the following ways:

1.By Internet:by following the internet voting instructions included on the proxy card at any time until 11:59 p.m., Eastern Daylight Time, on August 5, 2021.

2.By Telephone: by following the telephone voting instructions included on the proxy card at any time until 11:59 p.m., Eastern Daylight Time, on August 5, 2021.

3.By Mail: by marking, dating, and signing your proxy card in accordance with the instructions on it and returning it by mail in the pre-addressed reply envelope provided with the proxy materials. The proxy card must be received before the Annual Meeting.

Shares held in your name as the stockholder of record may be voted at the virtual Annual Meeting. Even if you plan to attend the virtual Annual Meeting, is necessarywe encourage you to constitute a quorum forvote in advance by internet, telephone or mail so that your vote will be counted in the transaction of businessevent you later are unable to participate in the Annual Meeting.

If your shares are held in street name, please follow the separate voting instructions you receive from your broker, bank, trustee, or other nominee.Shares held in street name may be voted at the Annual Meeting. Votes for and against, abstentions and “broker non-votes” will each be counted as present for purposes of determiningMeeting only if you obtain a legal proxy from the presence of a quorum.broker, trustee, or other nominee that holds your shares giving you the right to vote the shares.

The Annual Meeting may be adjournedOn or postponed from time to time and at any reconvened meeting, action with respect to the matters specified inabout June 21, 2021, we began sending this Proxy Statement, may be taken without further noticethe attached Notice of Annual Meeting of Shareholders, and the enclosed proxy card to all stockholders except as required by applicable law or our charter documents.

You are a “stockholder of record” if your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company. As a stockholder of record, you have the right to grant your voting proxy directly to the proxy holders designated by the Company orentitled to vote in person at the 2021 Annual Meeting. Although not part of this Proxy Statement, we are also sending, along with this Proxy Statement, our 2021 annual report on Form 10-K, which includes our financial statements for Fiscal 2021.

All shares represented by a proxy will be voted at the Annual Meeting, and whereMeeting. Where a stockholder specifies a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the specification so made. If a stockholder does not indicate a choice on the proxy card, the shares will be voted in favor of the election of the nominees for director contained in this Proxy Statement, in favor of approving, on an advisory, non-binding basis, the compensation of our named executive officers, and in favor of ratifying PKF O’Connor DaviesGrant Thornton LLP as the Company’sour independent registered public accounting firm for the fiscal year ending March 31, 2017.

You are deemed to beneficially own your shares in “street name” if your shares are held in an account at a brokerage firm, bank, broker-dealer, trust or other similar organization. If this is the case, you will receive a separate voting instruction form with this Proxy Statement from such organization. As the beneficial owner, you have the right to direct your broker, bank, trustee, or nominee how to vote your shares, and you are also invited to attend the Annual Meeting. If you hold your shares in street name and do not provide voting instructions to your broker, bank, trustee or nominee, your shares will not be voted on any proposals on which such party does not have discretionary authority to vote (a “broker non-vote”), as further described below under the heading “Broker Non-Votes.”

Please note that if your shares are held of record by a broker, bank, trustee or nominee and you wish to vote at the Annual Meeting, you will not be permitted to vote in person unless you first obtain a proxy issued in your name from your broker, bank, trustee, or nominee.

1

Broker non-votes are shares held by brokers, banks, trustees, or other nominees who are present in person or represented by proxy, but which are not voted on a particular matter because the brokers, banks, trustees, or nominees do not have discretionary authority with respect to that proposal and they have not received voting instructions from the beneficial owner. Under the rules that govern brokers, banks, trustees and other nominees, these entities have the discretion to vote on routine matters, but not on non-routine matters. The only routine matter to be considered at the Annual Meeting is the ratification of the appointment of the Company’s independent registered public accounting firm. The remaining proposal, the election of directors, is considered to be a non-routine matter. As a result, if you do not provide your broker, bank, trustee, or nominee with voting instructions on this non-routine matter, your shares will not be voted for the Company’s director nominees.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. The JOBS Act contains provisions that, among other things, reduce certain reporting requirements for an “emerging growth company.” For so long as we remain an emerging growth company, we are permitted and plan to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include reduced disclosure obligations regarding the compensation of our executive officers. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an emerging growth company until the earlier of (a) the last day of the fiscal year following January 26, 2020, (b) the last day of the fiscal year in which we have total annual gross revenues of at least $1.0 billion, (c) the date on which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million when measured as of the end of our prior second fiscal quarter (currently September 30th), or (d) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. Accordingly, the information contained in this Proxy Statement and the matters to be voted on at the Annual Meeting may not be as extensive as the information and proxy proposals submitted by other public companies that are not emerging growth companies.

Stockholders are entitled to cast one vote per share of common stock on each matter presented at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for a purpose related to the Annual Meeting during normal business hours at our executive offices for a period of at least 10 days preceding the date of the Annual Meeting.

There are two proposals scheduled to be voted on at the Annual Meeting:

|

|

|

|

Our Board recommends a vote FOR each of the director nominees and FOR proposal 2 listed above.

We are currently unaware of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Annual Meeting for consideration and you are a stockholder of record and have submitted your proxy, the persons named in your proxy will have the discretion to vote on those matters for you, provided that they will not vote in the election of directors for any nominee(s) from whom authority to vote has been withheld.

Proposal 1 – Election of Directors

Under our Amended and Restated Certificate of Incorporation, as amended, and our Amended and Restated Bylaws, directors are elected by a plurality of the votes cast in person or by proxy at the Annual Meeting, assuming a quorum is present, which means that the seven director nominees receiving the highest number of “FOR” votes will be elected. If you hold your shares through a broker, bank, trust, or other nominee and you do not instruct the broker, bank, trustee, or nominee on how to vote on this proposal,

2

your broker, bank, trustee, or nominee will not have authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum, but will not have any effect on the outcome of this proposal.

Proposal 2 – Ratification of Auditors

If a quorum is present, the affirmative vote of a majority of the votes cast at the Annual Meeting is required for ratification of our independent registered public accounting firm. Abstentions will be counted as present for purposes of determining the presence of a quorum but will not be considered as votes cast for or against this proposal, and will therefore have no effect on the outcome of the vote.

If you are a stockholder of record, you can vote in the following ways:

|

|

|

|

|

|

You may also vote your shares in person at the Annual Meeting. Even if you plan to attend the Annual Meeting, we encourage you to vote in advance by internet, telephone or mail so that your vote will be counted in the event you later decide not to attend the Annual Meeting.

If your shares are held in street name, please follow the separate voting instructions you receive from your broker, bank, trustee, or other nominee.

All shares represented by a proxy will be voted at the Annual Meeting, and where a stockholder specifies a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the specification so made. If a stockholder does not indicate a choice on the proxy card, the shares will be voted in favor of the election of the nominees for director contained in this Proxy Statement and in favor of ratifying PKF O’Connor Davies as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2017.2022. If any other business may properly come before the Annual Meeting, the proxies are authorized to vote in their

13

discretion, provided that they will not vote in the election of directors for any nominee(s) from whom authority to vote has been withheld.

If your shares are held by a broker, bank, trustee, or other nominee exercising fiduciary powers holds your shares (typically referred to as being held in “street name”), you should receive a separate voting instruction form with this Proxy Statement. Your broker, bank, trustee, or nominee may vote your shares on proposal 2,Proposal 3 but will not be permitted to vote your shares with respect to the election of directorsfor other proposals unless you provide instructions as toon how to vote your shares. Please note that if your shares are held of record by a broker, bank, trustee, or nominee, and you wish to vote at the meeting, you will not be permitted to vote in persononline at the virtual Annual Meeting unless you first obtain a proxy issued in your name from the record holder.

If you are a stockholder of record, you may revoke your proxy: (i)

1.by written notice of revocation mailed to and received by the Corporate Secretary of the Company prior to the date of the Annual Meeting, (ii)Meeting;

2.by voting again via the internet or by telephone at a later time before the closing of those voting facilities at 11:59 p.m. Eastern Daylight Time on August 9, 2016, (iii) 5, 2021;

3.by executing and delivering to the Corporate Secretary a proxy dated as of a later date than a previously executed and delivered proxy (provided, however, that such action must be taken prior to 11:59 p.m. Eastern Daylight Time on August 9, 2016),5, 2021); or (iv)

4.by attending the virtual Annual Meeting and voting in person.during the meeting. Attendance at the Annual Meeting will not in and of itself revoke a proxy.

3

If your shares are held by a broker, bank, trustee, or nominee, you may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee; or, if you have obtained a legal proxy from your broker, bank, trustee, or nominee giving you the right to vote your shares, by attending the virtual Annual Meeting and voting in person.during the meeting.

We will announce preliminary voting results at the Annual Meeting. We will report final results in a Current Report on Form 8-K report filed with the United States SecuritiesSEC.

Important notice regarding the availability of proxy materials for the 2021 Annual Meeting of Stockholders: This Proxy Statement for the 2021 Annual Meeting of Stockholders, our Annual Report to Stockholders on Form 10-K for the fiscal year ended March 31, 2021 (filed June 15, 2021) and Exchange Commission (the “SEC”).the proxy card or voting instruction form are available on our website at www.investors.anterix.com/financials/annual-reports-and-proxies.

14

4

At the Annual Meeting, our stockholders will vote on the recommendationelection of nine directors to serve until our 2022 Annual Meeting and until their respective successors are elected and qualified.

Election Process and Recommendation

In an uncontested election, the directors are elected by a majority of the votes cast in person or by proxy at the Annual Meeting, assuming a quorum is present. This means that the number of shares voted “FOR” a nominee for election as a director must exceed the number of votes cast “AGAINST” that director nominee. If you hold your shares in street name and you do not instruct the broker, bank, trustee, or nominee on how to vote on this proposal, they will not have authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not be voted for or against the election of any director nominee, and so will not have any effect on the outcome of this proposal.

We have also implemented a majority voting policy for director resignations, which is applicable if an incumbent director nominee receives less than a majority of votes cast in an uncontested election. If a director nominee fails to receive the required vote for reelection, our Nominating and Corporate Governance Committee has nominated each of our seven existing directors(other than such director) will act on an expedited basis to determine whether to accept the director's irrevocable, conditional resignation, and it will submit such recommendation for election atprompt consideration by the Annual Meeting. Directors are elected by a pluralityBoard. The Nominating and Corporate Governance Committee and members of the votes cast at the Annual Meeting, which means that the sevenBoard (other than such director) may consider any factors they deem relevant in deciding whether to accept a director's resignation. This policy does not apply in circumstances involving contested director nominees receiving the highest number of “FOR” votes will be elected as directors. elections.

All of our director nominees have indicated their willingness to serve if elected, but ifelected. If any of our director nomineesnominee should be unable or unwilling to stand for election, the shares represented by proxyproxies may be voted for a substitute designatedas the Board may designate, unless a contrary instruction is indicated in the proxy.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR, AND SOLICITS PROXIES IN FAVOR OF, EACH OF OUR DIRECTOR NOMINEES.

Unless otherwise instructed, it is the intention of the persons named in the proxy card to vote shares represented by properly executed proxy cards for the election of each of our Board.director nominees.

Board of Directors Information

Our Board, based on the recommendation of our Nominating and Corporate Governance Committee, has nominated all of our nine existing directors for re-election.

In addition to the information set forth below regarding our director nominees and the skills that led our Board to conclude that these individuals should serve as directors, we believe that all of our director nominees have a reputation for integrity, honesty, and adherence to the highest ethical standards. We believe they each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our Company and their Board duties.

The following sets forth information regarding the business experience of our directorsdirector nominees as of June 28, 2016:11, 2021:

|

|

|

|

|

|

|

|

Name | Age | Position with Anterix | Director Since |

Morgan E. O’Brien | 76 | Executive Chairman & Director Nominee | 2012 |

Robert H. Schwartz | 55 | President & Chief Executive Officer & Director Nominee | 2020 |

Hamid Akhavan | 59 | Director Nominee | 2020 |

Leslie B. Daniels | 74 | Director Nominee | 2020 |

Gregory A. Haller | 54 | Director Nominee | 2018 |

Singleton B. McAllister | 69 | Director Nominee | 2018 |

Gregory A. Pratt | 72 | Director Nominee | 2020 |

Paul Saleh | 64 | Director Nominee | 2016 |

Mahvash Yazdi | 69 | Director Nominee | 2021 |

|

|

| ||

|

|

| ||

|

|

| ||

Morgan E. O’Brien |

|

|

| |

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Brian D. McAuley. Mr. McAuley has served as our Chairman of the Board since August 2004. Mr. McAuley is a co-founder of Nextel Communications, Inc. and held senior executive positions at Nextel from its inception in 1987 until 1996, including seven years as President and Chief Executive Officer. Upon leaving Nextel, he joined Imagine Tile, Inc., a custom tile manufacturer, where he served as Chairman and Chief Executive Officer from 1996 to 1999, and where he continues to serve as Chairman of the Board. He also served as President and Chief Executive Officer of NeoWorld Communications, Inc., a wireless telecommunications company, from 1999 until the sale of that company to Nextel in 2003. Mr. McAuley is a certified public accountant and, prior to co-founding Nextel, his positions included Chief Financial Officer of Millicom Incorporated, Corporate Controller at Norton Simon Inc. and Manager at Deloitte & Touche LLP. He also currently serves on the board of directors of United Rentals (NYSE: URI). Mr. McAuley has a Bachelor’s of Business Administration Degree from Adelphi University and is a member of various finance and telecommunications industry organizations.

We believe Mr. McAuley is qualified to serve on our Board based on his prior experience in founding, building and serving as an executive officer at leading telecommunications companies, his prior experience in building a nationwide dispatch network at Nextel, and his experience serving on the boards of directors of other private and public companies.

Morgan E. O’Brien. Mr. O’Brien has been our Executive Chairman since July 2020. He has also served as a member of our Board since April 2012, as Chief Executive Officer from May 2018 to July 2020, and as Vice Chairman sinceof our Board from May 2014.2014 to April 2018. From January 2009 to the present, Mr. O’Brien has served as an independent consultant to several wireless start-upsstart-ups and, until June 20162017, served as a member of the board of directors of GTT Communications, Inc. (NYSE: GTT). As thea co-founder and chairman of Nextel, Mr. O’Brien led the creation of the first all-digital nationwide wireless network (the Nextel National Network) and brought push-to-talk (PTT) communication to the mass business and consumer market. After the merger of Nextel with Sprint Corporation in 2004, he was a co-founder of Cyren Call Communications Corporation, where he served until January 2009. Mr. O’Brien was recognized in 1987 as New Jersey Entrepreneur of the Year and was voted the RCR Person of the Year in 1993 and again in 2006. In 2005, he was inducted into the Washington, DC Business Hall of Fame, and in 2007 he was named a Fellow of the Radio Club of America and was named by Fierce Wireless as “one of the top U.S. wireless innovators of all time.” In 2016, Mr. O’Brien was awarded the Armstrong Medal, the highest award of the Radio Club of America, for demonstrated excellence and lasting contributions to radio arts and sciences. Mr. O’Brien has also served on a number ofseveral boards of other public companies, including Sprint and Williams Telecommunications. He also serves on the board of several private companies and charitable organizations. Mr. O’Brien is a graduate of Georgetown University and received his law degree from Northwestern University.

16

We believe Mr. O’Brien is qualified to serve on our Board based on his significant experience driving leading-edge strategic solutions in the telecommunications sector, prior experience in founding, building, and serving as an executive officer at Nextel and Cyren Call Communications, his prior experience in building a nationwide dispatch network at Nextel, his expertise in FCC licensingregulatory and compliance matters, and his experience serving on the boards of directors of other private and public companies.

| Robert H. Schwartz |

5

John C. Pescatore. Mr. Pescatore has served asSchwartz was appointed our President & Chief Executive Officer in July 2020 and a member ofwas elected to our Board since August 2004. He is a seasoned telecommunications executive with particular expertise in rapidly growing companies. September 2020.Having joined the Company in 2015 as Chief Strategy and Development Officer, he became our President & Chief Operating Officer in May 2018. Prior to his current rolejoining our Company, beginning in 2013, Mr. Schwartz served as our President and Chief Executive Officer he was Executive Vice Presidentof STI Brasil, LLC, a company focused on developing shared fiber infrastructure for wireless operators in Brazil. Prior to STI, from 2009 to 2013, Mr. Schwartz served as a Managing Director of Unison Site Management, during which time Unison acquired and Chief Operating Officer of NeoWorld Communications. NeoWorld was founded to develop and launch a nationwide dispatch system and held spectrum in major marketsmanaged cell site easements throughout the United States. The companyStates and sold its site portfolio to American Tower. From 2006 to 2009, Mr. Schwartz was successfully soldManaging Partner of Woodmont Partners LLC, a strategic consultancy to Nextel Communications in 2003. Prior to that,telecom, media, and technology companies, including software, wireless, and cable companies. Earlier, Mr. PescatoreSchwartz was Executive Vice President of Operations with Expanets, Inc., one ofIDT Telecom from 2001 to 2006, and led corporate development, product management, and the fastest growing voice and data communications solutions and services companies in the United States during his tenure.wireless division. In 1996, Mr. Schwartz joined The Associated Group to launch Teligent. He was one of the key architects in building Expanets and saw the business through enormous growth by strategic acquisitions. Prior to that, Mr. Pescatore was part of the team involved in the start-up of Nextel, where he held numerous senior leadership positions includingbecame Teligent’s Senior Vice President of Operations, President ofCorporate Development, leading functions including strategy, capital markets, investor relations, and M&A activities through the Two-Way Radio Division,startup, initial public offering, and President of the New York Area during its digital system rollout. Priorsale to Nextel,Liberty Media. Mr. Pescatore was a consultant with Deloitte & Touche LLP. He earned his undergraduate degree in accounting from New York University and earned his certified public accountant certification.

We believe Mr. Pescatore is qualified to serve on our Board based on his service as an executive at leading telecommunications companies, his expertise in the wireless communications industry and his financial and accounting expertise.

T. Clark Akers. Mr. Akers joined our Board upon the completion of our June 2014 private placement. He has been a Managing Director, SBIC Funds Placement Division at FBR & Co., a Washington, D.C. based investment banking firm, since September 2015. His responsibilities at FBR & Co. include raising capital for Small Business Investment Company (SBIC) funds for experienced U.S. investment managers. Prior to FBR & Co., Mr. Akers was a Managing Director at Commerce Street Capital, a Dallas based investment banking firm. Mr. Akers serves on the advisory board of Pharos Capital Group, a private equity firm based in Nashville and Dallas. Mr. Akers serves on the board of the Fred Jones Companies, the automotive affiliate of Hall Capital, an Oklahoma City based family office. HeSchwartz also serves on the Advisory Board of Hall Capital Partners, the private equity affiliate of Hall Capital. Mr. Akers also serves on the Board of Managers and is a founder and Vice President of Continuum 700 LLC, a wireless start-up that has acquired ten 700 MHz A Block licenses covering a population of approximately 12 million people. In preparation to bid on those licenses in a 2008 FCC 700 MHz spectrum auction, Mr. Akers and his partners raised $68 million of capital for Continuum 700 LLC. Mr. Akers recently served as Vice ChairmanDirector of Intechra, the largest electronic wasteCorporate Development at Nextel and asset disposal company in the U.S. As a founder of Intechra, Mr. Akers raised $50 million of equity that was necessary for the organic and acquisitive growth which marked Intechra’s rise to leadership in the e-waste business. Additionally,its precursor Fleetcall where he was responsible for recruitingsupporting key membersstrategic, M&A, and capital markets initiatives. Mr. Schwartz holds an MBA from the Wharton School at the University of Intechra’s management team. Following those initiatives, he worked closely with the sales team on targeted Fortune 100 business development efforts. Mr. Akers’ tenure with Intechra began in 2004Pennsylvania and ended in 2009. Prior to Intechra, Mr. Akers served as Senior Vice President of External Affairs for TeleCorp PCS, Inc., the ninth largest wireless phone company in the U.S. before its acquisition by AT&T Wireless in 2002. Mr. Akers holds Series 7, Series 63 and 24 License Registrations with the National Association of Securities Dealers, Inc. Mr. Akers received hisa Bachelor of Arts degreein Business Administration from Vanderbilt University in 1979.George Washington University’s School of Government & Business Affairs.

We believe that Mr. AkersSchwartz is qualified to serve on our Board based on his prior experience as an executive in the telecommunications industry, his experiencespecifically in providing fund raising and advisory services to growth companies, his knowledge of the capital marketswireless communication, and his prior experience serving on the boards of directors of other companies.developing nascent communication technologies.

| Hamid Akhavan |

Andrew Daskalakis. Mr. DaskalakisAkhavan has served as a member of our Board since September 2020. He has been a Partner at Twin Point Capital, a growth-oriented private equity firm based in New York, NY and Palo Alto, CA, since April 2018. From August 2004.2016 to March 2018, he was a Partner at Long Arc Capital, a private equity firm specializing in disruptive technology investments. From 2010 to 2014, Mr. Daskalakis currently servesAkhavan served as PresidentChief Executive Officer of AMK International,Unify Inc. (formerly Siemens Enterprise), an investment funda global supplier of telecommunication products, software, and services. Prior to that, he founded over 15 years ago.served as Chief Operating Officer of Deutsche Telecom and Chief Executive Officer of T-Mobile International. He has over 30 yearsbegan his career at the Jet Propulsion Laboratory (NASA) and Bell Communications Research. He holds a Bachelor of experienceScience in electrical engineering and computer science from California Institute of Technology and a Master of Science in the wireless communications industrysame fields from Massachusetts Institute of Technology. Mr. Akhavan also serves on the board of directors of Vonage (NASDAQ GS: VG) and has successfully operated a dispatch radio business. A wireless industry pioneer, he has held engineering management positions with AT&T’s Bell Labs where he was co-inventor of the Cellular Telephone System. He has also held senior executive positions with Motorola, Satellite Business Systems, and was President and CEO of Cellular Telephone Co. He has also served as a consultant for Nextel. Mr. Daskalakis received a Bachelor’s of Science Degree in Electrical Engineering from the Drexel University and a Master’s Degree in Electrical Engineering from New York University.privately-held National Broadband Ireland.

We believe that Mr. DaskalakisAkhavan is qualified to serve on our Board based on his leadershipsignificant telecommunications and technology expertise, his prior public company board experience, as anwell as leadership skills from his role as chief executive in the telecommunications industry, his expertise in operationsat Unify and investing in growth companies, his prior experience with building and operating a dispatch radio business and his experience serving as a director on other boardsCEO of directors.T-Mobile International.

17

| Leslie B. Daniels |

Peter G. Schiff. Mr. SchiffDaniels has served as a member of our Board since August 2004.September 2020 and is Chair of the Strategy Committee. He also currently serves as Managingis an Operating Partner of Northwood Ventures,AE Industrial Partners, L.P., a venture capital firm he founded in 1983. Prior to founding Northwood, Mr. Schiff worked in the private equity division of E.M. Warburg, Pincus & Co.,firm in Boca Raton, FL, specializing in aerospace, power generation, and previously had been an officer in the corporate division of Chemical Bank (now JPMorgan Chase & Co.)specialty industrial markets. He serves on the board of directors of GAMCO Investors, Inc. (NYSE: GBL) and Moeller Aerospace and is an Advisor to LGL Systems Acquisition Corp. (NYSE: DFNS). Mr. Daniels serves on The Advisory Committee on Trade Policy and Negotiation as a directorformer President Trump appointee. He is a former chairman and former member of manyFlorida’s State Board of Northwood’s portfolio companies.Administration, Investment Advisory Council, and serves as Commissioner and Chairman of the Health Care District of Palm Beach County. Mr. Schiff graduatedDaniels was a founding partner of CAI Managers & Co., L.P., a private equity firm located in New York City from Lake Forest College and received an M.B.A. from University of Chicago’s Booth School of Business with concentrations in Finance and Marketing. In 2009,1989 to 2014. Prior to CAI Managers, he was awarded the honorary degreePresident of Doctor of Laws by the Lake Forest College after servingBurdge, Daniels & Co., Inc., a company engaged as a trusteeprincipal in venture capital and buyout investments and trading of private placement securities. Mr. Daniels also served as Senior Vice President of Blyth, Eastman, Dillon & Co., where he was responsible for 16 years, culminating in servingits corporate fixed-income sales and trading departments. Mr. Daniels is a former Director of AeroSat Corporation; Aster-Cephac SA; Bioanalytical Systems, Inc.; Douglas Machine & Tool Co., Inc.; IVAX Corporation; MIM Corporation; MIST Inc.; Mylan Laboratories Inc.; NBS Technologies Inc.; and Safeguard Health Enterprises, Inc. He served as its Chairman.Chairman of TurboCombustor Technology Inc. and Zenith Laboratories, Inc. Mr. Schiff also serves asDaniels is a trustee and secretarygraduate of Hofstra University and as aFordham University.

6

member of the Joint Board of Overseers of the Hofstra North Shore – LIJ School of Medicine. Northwood was an early investor in several enterprise focused carriers including Nextel, Dispatch Communications, NeoWorld, PowerFone and TeleCorp.

We believe that Mr. SchiffDaniels is qualified to serve on our Board based on his extensive financial and M&A experience, in advising and investing in growth companies in the communications industry,as well as his knowledgedepth of the capital markets and his experience serving as a director on other boards of directors.numerous public companies.

| Gregory A. Haller |

John C. Sites Jr.Mr. SitesHaller has served as a member of our Board since August 2004.November 2018. He has beenmore than 30 years of experience serving as a partnersenior executive in the wireless and telecommunication services industries. Since July 2018, he has served as the Chief Operating Officer at Wexford Capital since 2008,Alorica, Inc. (“Alorica”), a leading customer relationships management company. At Alorica, Mr. Haller is responsible for global operations, client solutions, global business services, and joined Wexford Capital in 2006, where he focuses on private and public equity investing.marketing communications. Prior to joining WexfordAlorica, Mr. Haller served in 2006,a number of senior executive positions at Verizon Wireless (NYSE: VZ) (“Verizon”). From August 2016 to June 2018, Mr. Haller was the chief executive for Verizon’s prepaid brand, Visible. Prior to that, from January 2012 until August 2016, he was a general partnerthe president of Daystar Special Situations Fundthe west area for all Verizon sales and Rock Creek Partners II, Ltd for ten years.operations, which encompassed the 18 most western states in the U.S. From 1981 to 1995, Mr. Sites was employed by Bear Stearns & Co., Inc., whereSeptember 2010 through January 2012, he reachedheld the positionroles of ExecutivePresident, Enterprise and Government Markets, and Vice President of Consumer Marketing. Through his 29-year career at Verizon, he also served in leadership positions in the areas of operations, sales, marketing, and was a member of the board of directors. While at Bear Stearns,advanced solutions, as well as consumer product portfolio and pricing. Mr. Sites established the firm’s mortgage and asset-backed department, served on the firm’s executive and compensation committees, was co-head of the taxable fixed income group and oversaw Bear Stearns’ Asset Management and the Financial Institutions Group. From 1974 to 1981, Mr. Sites worked at Trading Company of the West, First Pennco Securities, and Morgan, Keegan & Company. Mr. Sites holds a Bachelor’sHaller received his Bachelor of Arts Degree in Economicsbusiness administration from Rhodes College and is a member of Phi Beta Kappa.Wittenberg University.

We believe Mr. SitesHaller is qualified to serve on our Board based on his prior executive leadership experience at leading companies in investing in privatethe wireless and public growth companies, his knowledge of the capital marketstelecommunications services industries and his experience serving as a director on other boards of directors.expertise in developing and executing business strategies.

No Family Relationships

There are no family relationships between any of our officers and directors.

Board Committees

|

|

18

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

|

Compensation Committee. The Compensation Committee is comprised of threeMs. McAllister has served as a member of our independent directors, Peter G. Schiff, John C. SitesBoard since June 2018, as Lead Independent Director since September 2020, and Andrew Daskalakis. Mr. Schiff is the chairperson of the Compensation Committee. The functions of the Compensation Committee include the approval of the compensation offered to our executive officers and recommendation to the full Board of the compensation to be offered to our non-employee directors. In accordance with the listing standards of the NASDAQ Stock Market, the Compensation Committee evaluates the independence of each compensation consultant, outside counsel and advisor retained by or providing advice to the Compensation Committee. Our Board has determined that each of Messrs. Schiff, Sites and Daskalakis is an “independent director” under the listing standards of the NASDAQ Stock Market and the applicable rules of regulations of the SEC, including the additional requirements that apply to members of the Compensation Committee. In addition, the members of the Compensation Committee each qualify as “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act and as “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended. The Compensation Committee is governed by a written charter approved by our Board, a copy of which is available on our website at www.pdvwireless.com.

Audit Committee. The Audit Committee is comprised of three of our independent directors, T. Clark Akers, Peter G. Schiff and John C. Sites, each of whom is able to read and understand fundamental financial statements, including our balance sheet, statements of operations, stockholders’ equity and cash flows as required by the rules of the NASDAQ Stock Market. Mr. Akers is the chairperson of the Audit Committee. The functions of the Audit Committee include the retention of our independent registered public accounting firm, reviewing and approving the planned scope, proposed fee arrangements and results of our Company’s annual audit, reviewing the adequacy of our Company’s accounting and financial controls and reviewing the independence of our Company’s independent registered public accounting firm. Our Board has determined that each member of the Audit Committee is an “independent director” under the listing standards of the NASDAQ Stock Market and the applicable rules and regulations of the SEC. Our Board has also determined that each of T. Clark Akers, Peter G. Schiff and John C. Sites is an “audit committee financial expert” within the applicable requirements of the SEC. The Audit Committee is governed by a written charter approved by our Board, a copy

7

of which is available on our website at www.pdvwireless.com. The charter complies with the applicable provision of the Sarbanes-Oxley Act and related rules of the SEC and the NASDAQ Stock Market.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is comprised of three of our independent directors, Andrew Daskalakis, T. Clark Akers and Peter G. Schiff. Mr. Daskalakis is the chairpersonChair of the Nominating and Corporate Governance Committee. The functionsMs. McAllister is currently serving as Of Counsel at the law firm Husch Blackwell, LLP (“Husch Blackwell”) and a Senior Advisor with Husch Blackwell Strategies. Before joining Husch Blackwell in May 2014, Ms. McAllister served as a partner in the law firms of Williams Mullen from 2012 to 2014, Blank Rome LLP from 2010 to 2012, and LeClairRyan from 2007 to 2010. Prior to entering private practice, Ms. McAllister served for five years as the general counsel for the United States Agency for International Development and previously served in senior positions in the U.S. House of Representatives. Ms. McAllister is a director of Alliant Energy Corporation (NYSE: LNT) and serves on its Nominating and Governance Committee and a past Chair of its Compensation and Personnel Committee. She also serves on the Proxy Board of Securitas Infrastructure Services, Inc. She has been a member of the Blue-Ribbon Advisory Board on Compensation and Personnel issues for the National Association of Corporate Directors’ (“NACD”). Most recently, she was recognized in 2018 as one of the top Corporate Directors of NACD. She also served as a director of United Rentals (NYSE: URI) from 2004 to May 2018 and previously chaired the National Women’s Business Center. Ms. McAllister is a member of the Council on Foreign Relations, fellow to the National Academy of Public Administration, and Vice-Chairman of the National Women’s History Museum Board of Directors. She has also served on the Advisory Board of the African Development Foundation and has been appointed Secretary to the Virginia State Board of Elections. Ms. McAllister has a Bachelor of Arts from the University of Maryland and completed Graduate Studies in International Relations and earned her law degree from Howard University.

We believe Ms. McAllister is qualified to serve on our Board based on her legal, regulatory and corporate governance experience and expertise, as well as her current experience serving on the boards of directors of other public and private companies, including public and private utility companies.

| Gregory A. Pratt |

Mr. Pratt has served as a member of the Board since May 2020 and is Chair of the Compensation Committee.Mr. Pratt is the Chairman of the Board of Directors at Carpenter Technology Corporation and served as interim President and Chief Executive Officer of Carpenter in fiscal years 2010 and 2015. Mr. Pratt is a former Vice Chairman and director of OAO Technology Solutions, Inc. ("OAOT"), an information technology and professional services company. He joined OAOT in 1998 as President and Chief Executive Officer after OAOT acquired Enterprise Technology Group Inc., a software engineering firm founded by Mr. Pratt. Mr. Pratt served as President and Chief Operations Officer of Intelligent Electronics, Inc. from 1991 through 1996, and was co-founder and served variously as Chief Financial Officer and President of Atari (US) Corporation from 1984 through 1991. Mr. Pratt serves as Chairman of the Nominating and Corporate Governance Committee include the identification, recruitment and nomination of candidates for our Board and its committees, making recommendations to our Board concerning the structure, composition and functioning of our Board and its committees (including the reporting channels through which our Board receives information and the quality and timeliness of the information), developing and recommending to our Board corporate governance guidelines applicable to our Company and annually reviewing and recommending changes (as necessary or appropriate), overseeing the annual evaluation of our Board’s effectiveness and performance, and periodically conducting an individual evaluation of each director. Our Board has determined that eacha member of the NominatingAudit Committee at Tredegar Corporation (NYSE: TG). He served as a Director and Corporate GovernanceAudit Committee Chairman of AmeriGas Propane. Inc., a public company listed on the NYSE for seven years. Mr. Pratt is an “independent director” undera NACD Board Leadership Fellow. He has demonstrated his commitment to boardroom excellence by completing NACD's comprehensive program of study for experienced corporate directors, which is a rigorous suite of courses spanning leading practices for boards and committees. He also was appointed to serve a three-year term on the listing standardsStanding Advisory Group of the NASDAQ Stock MarketPublic Company Accounting Oversight Board ending November 2016. He supplements his skill sets through ongoing engagement with the director community and access to leading practices. Mr. Pratt received his MBA in finance from the Wharton School, University of Pennsylvania, and his Bachelor of Science in business administration from Cheyney University. He is a certified public accountant.

We believe Mr. Pratt is qualified to serve on our Board based on his financial and corporate governance experience and expertise, as well as his current experience serving on the boards of directors of other public companies and as a former CEO.

19

| Paul Saleh |